Compliance Monitor

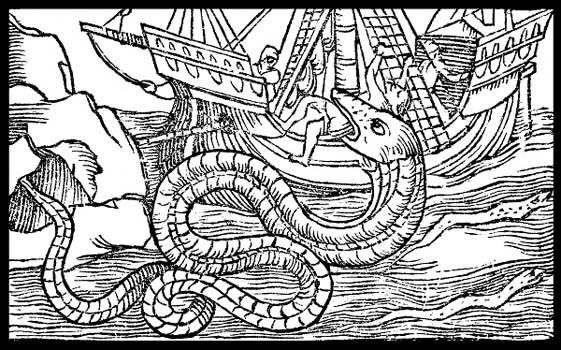

IFA links with unauthorised introducers: here be dragons

In a recent tribunal case, over 2,000 consumers lost more than ?50 million after financial advice firms steered their pension savings to high-risk products in which an unauthorised firm had a significant interest. The regulator should use its powers to close a business or impose a new CEO, compliance officer or section 166 Skilled Person more often, says Adam Samuel.

Adam SamuelBA LLM DipPFS MCISI FCIArb Certs CII (MP&ER) Barrister and Attorney may be contacted atadamsamuel@aol.com.For links to where you can buy the second edition of 'Consumer Financial Services Complaints and Compensation', see www.adamsamuel.com/book.

The recent Upper Tribunal decision in Andrew Page, Robert Ward, William Freer, Thomas Ward and Aiden Henderson contains an

important description of the obligations of a financial adviser. This, though, sits within the framework of a case sufficiently

disturbing as to raise bigger unanswerable questions about the future of regulation and the way society values people. Even

after 308 pages, the tribunal has only touched the tip of a thoroughly putrid iceberg.