Lloyd's Maritime and Commercial Law Quarterly

PERFORMANCE BONDS: USE AND USEFULNESS

Karen P. Williams

Lecturer in Law, University of Essex.

Introduction

Performance bonds have long been in use within the construction industry, an industry where failures in completion and defaults in performance by contractors are not uncommon, and where the number of insolvencies has been particularly high.1 A performance bond2 may be defined as one type of surety contract,3 that is, a contract made between three parties—the principal debtor (the contractor), the creditor or beneficiary (the employer) and the surety or guarantor—whereby the surety undertakes to answer for the debt, default or miscarriage on the part of the principal debtor.4 The bond is a contract subsidiary to the main construction contract concluded between the contractor and employer, and all terms of the latter are incorporated within it.

By requiring a potential contractor to provide a performance bond, valued at a percentage of the contract price5 and issued by a reputable source,6 an employer secures for himself a certain sum of money which may be demanded from the surety by calling in the bond should the contractor default in his obligations under the construction contract.7 Where such action is necessary, the employer would hope to

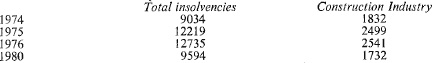

1 Statistics obtained from the Department of Trade and Industry show that bankruptcies and company liquidations in the construction industry account for about one-fifth of total insolvencies. The figures for 1974–1976 and 1980 are reproduced below:

2 Alternatively the phrase “contract guarantee bond” may be adopted.

3 Alternatively the phrase “contract of guarantee” may be adopted.

4 See Halsbury’s Laws 4th edn., Chapter 20, para 203. The same principles apply to other types of bond which may be obtained instead of, or in addition to, performance bonds, namely tender or bid bonds, advance payment bonds, release of retention moneys bonds, labour and materials payment bonds, maintenance period bonds (alternatively this period may be included within the performance bond period).

5 This amount would usually be 10%, although a higher percentage may be required by some employers.

6 This will be a bank or surety company.

7 The contractor remains primarily liable to fulfil his obligations under the main contract; the surety’s liability is secondary, arising only upon the failure of the contractor. In this context a surety contract must be distinguished from a contract of indemnity, the latter being an independent contract made between two parties by virtue of which the promisor undertakes to make recompense for all losses incurred by the other party. The distinction is one of substance, not form, see Western Credit Ltd. v. Alberry [1964] 2 All E.R. 938, and is important because a contract of indemnity is subject to the principle of uberrima fides, whereby failure to disclose all material facts to the indemnifier will release him from his obligations. No such principle operates in relation to surety contracts, although the principal debtor must ensure that he does not mislead the surety—see Bank of India v. Trans Continental Commodity Merchants Ltd. and Another, The Times, 27th October 1981.

423