Lloyd's Maritime and Commercial Law Quarterly

BRIEFS FROM LLOYD’S LAW REPORTS

(Editor—Mavis M. D’Souza)

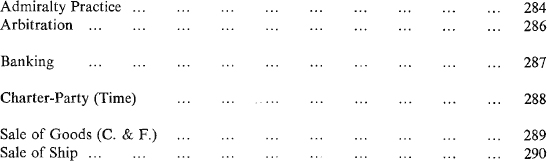

Subject heading with page numbers

22. ADMIRALTY PRACTICE — Appraisement and sale of vessel — Plaintiffs alleged cost of maintaining vessel under arrest exceeded £5000 per month — Whether vessel should be sold for benefit of creditors.

On July 3, 1984, the plaintiffs issued a writ in rem against the defendants’ vessel Gulf Venture in which they claimed the sum of £409,926 for goods materials, crew, expenses, agency expenses, port charges and other miscellaneous related expenses incurred by them as port agents at various ports in Nigeria in respect of the ships, Gulf Venture and Gulf Princess.

Gulf Venture was arrested at Sharpness on July 4, 1984, and on July 18, 1984, the defendant’s application to set aside the service of the writ and that the vessel be released from arrest was dismissed. However, an order was made that upon provision by the defendants of security in the sum of £250,000 the vessel would be released from arrest. The defendants declined to put up any security. The plaintiffs therefore applied for an order that the vessel be appraised and sold pendente lite on the ground that the cost of maintaining the arrest of Gulf Venture exceeded £5000 per month and that she was a wasting asset and ought to be sold for the benefit of all creditors with claims against the defendants. The motion was resisted by the defendants and by the interveners, the second mortgagees, Gulf Investment Inc. The first mortgagees, International Westminster Bank Plc. entered a caveat against the release of the vessel Gulf Venture on July 20, 1984.

Held, by Q.B. (Adm. Ct.) (Sheen, J.), that (1) if the plaintiffs obtained a judgment in their favour it seemed probable that that judgment would not be satisfied by payment by the defendants; in that event the plaintiffs would have to obtain an order for the sale of the ship; if the bank intended to intervene to enforce their security if and when a sale of the ship was ordered by the Court it was in the interest of the bank that they did so now rather than a year later; if Gulf Venture remained under arrest for one year the security available to the bank would have been reduced by at least £60,000; (2) whether the security would be sufficient would depend upon the terms of the various mortgages; but if the mortgagees were now entitled to enforce one or more of the mortgages, delay in the sale of the ship could only have the effect of increasing the costs of maintaining the vessel under arrest which took priority over the mortgages thereby reducing the security available; (3) in the circumstances the order that Gulf Venture be appraised and sold by the Admiralty Marshal would be made.

——The Myrto, [1977] 2 Lloyd’s Rep. 243, applied.

THE GULF VENTURE.

[1985] 1 Lloyd’s Rep. 131.

284